Credit Risk Solutions

As your credit risk management partner, our role goes beyond providing statistics and figures. With over 240 million business records at your fingertips, tap onto our proprietary credit ratings and financial information to enable you to confidently assess the risks associated with your customers and to limit credit risk exposure.

Identify potential risks and opportunities

Find out who your potential business partners, suppliers, clients are before embarking on your exciting new business venture. Similarly, we conduct periodic reviews on existing suppliers and customer risks for you.

Protect your interests against evolving threats

In an ever-changing and unpredictable economy, gain clear insights and the latest up-to-the minute data of your prospective and existing customers.

Make Data-Driven Decisions

With over 450 million business credit records at your fingertips, manage your risks wisely with our proprietary and easy-to-understand credit rating systems.

Our Services

Business Credit Reports comes in any shapes and sizes – just like umbrellas, thicker ones will shade you better from the sun, curved ones will protect you better from the rain, decorative parasols to match attires for special events. Depending on the nature of your business transactions and your level of credit risk exposure (and risk appetite), we offer a range of credit reports ideal for your assessment.

Medium to High Risk Transactions

Business Information Report

Find Out More

High Risk

Transactions

Comprehensive Report

Find Out More- Company Registration Details and Registered Charges

- Ownership/ Management Background

- Credit Assessment Rating

- Payment Information

- Business and Trading Operations

- Financial Statements

- Various Narrative Analyses and Ratings on the Subject Company

- Related Companies

- Bankers’ Details

- Litigation Information

- Key Ratios including Financial Ratio Analysis

- Cash Flow Analysis

Comprehensive Report

A complete coverage of information necessary to make confident credit decisions for High Risk Transactions.

Risk

Coverage

Depth

- Brief Company Registration Details and Registered Charges

- Corporate Directors and Shareholders

- DUNS Number

- Risk Assessment featuring CRI

- D&B Rating

- Payment and Collection Information

- Current Investigations

- Financial Statements

- Comparison with Industrial Norms

- Court Actions

- Terms of Trade

- Media Releases

Business Information Report

A detailed business credit report for business credit decisions, the Business Information Report™ helps mitigate potential business risks by avoiding payment defaults and assessing a company’s business credit risk with straightforward risk indicators such as Payment Summary and D&B® Rating.

Risk

Coverage

Depth

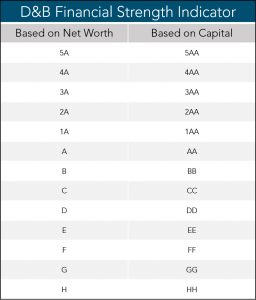

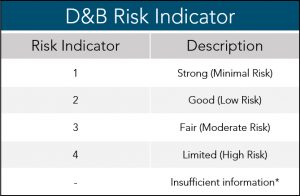

D&B Rating

A value-added tool which provides a quick assessment of a company’s size and composite credit appraisal,

based on information in a company’s interim or fiscal balance sheet and an overall evaluation of the company’s credit-worthiness.

The D&B Rating consists of the following indicators:

Financial Strength

Risk Indicator

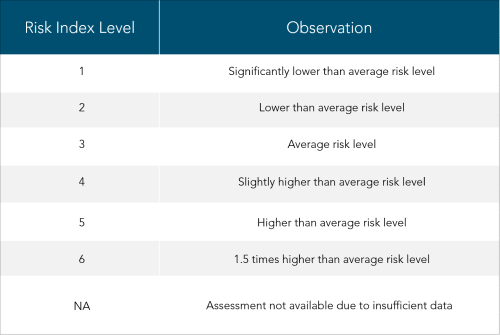

D&B Credit Risk Index

The D&B’s Credit Risk Index (CRI) provides a quick assessment of a business’s risk standing based on observed business failure of companies in Malaysia. CRI is derived from key criteria including Business Information, Payment Information, Public Filings and Financial Information available in the report.

Based on a scale of 1 to 6, where 1 represents a lower and 6 a higher percentage of observed Business Failures.

The Risk Index is related to observed business failure. Although the index does not predict the probability of business closure, it reflects from a database profiling approach, the ratio of failed to operating businesses for a Risk Index Level.

D&B Country Risk Update

Comprehensive information sources for evaluating risk and opportunities around the globe

This newsletter features analysis from D&B Country Risk Services – an unrivalled source of information and analysis for those involved in international trade. Our analysis is supplemented by primary data from national and international sources and secondary data from the International Monetary Fund, World Bank and other multilateral organisations, providing a unique insight into the relative performance of different countries.

Here you can find key extracts from D&B’s extensive coverage of the issues affecting businesses trading overseas. The featured countries provide an analytical focus on recent areas of concern for international trade and help you to determine the risks involved in doing business in a country.